![]() ARTICLE

ARTICLE

Posted March 08, 2024

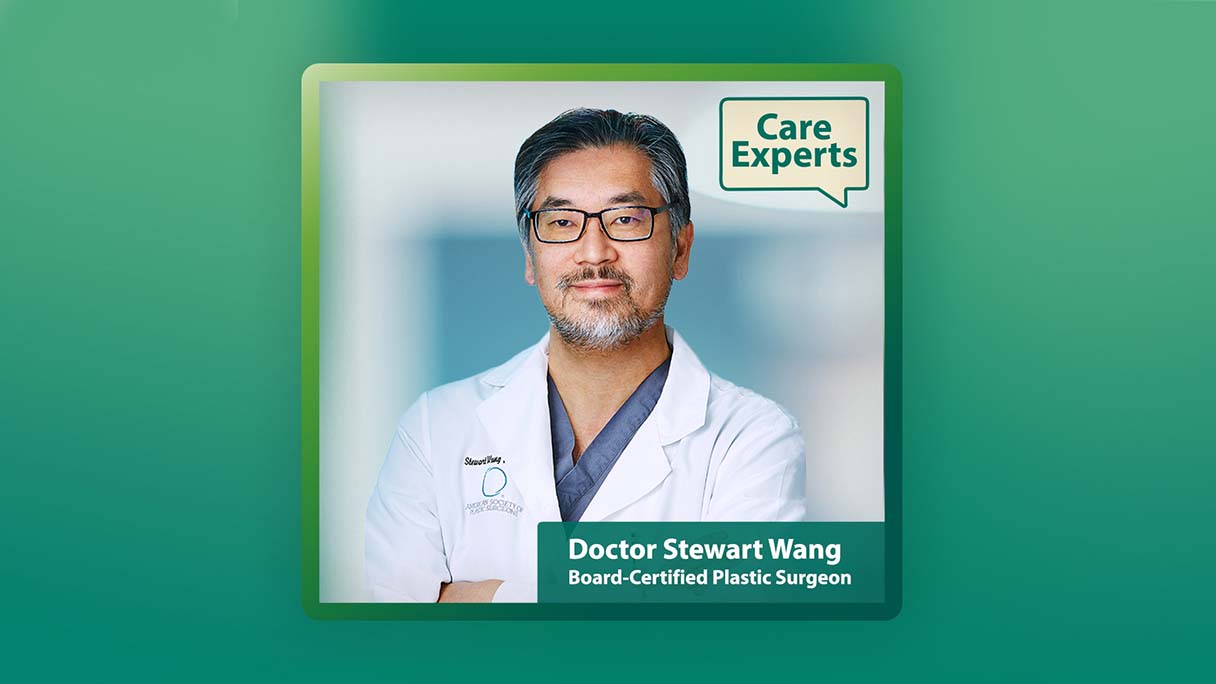

Paying for Elective Plastic Surgery: Things to Consider

If you're interested in elective plastic surgery, cost coverage by insurance can be tricky unless it's reconstructive or medically necessary. Learn more about available options to cover the costs of these procedures.

Read more