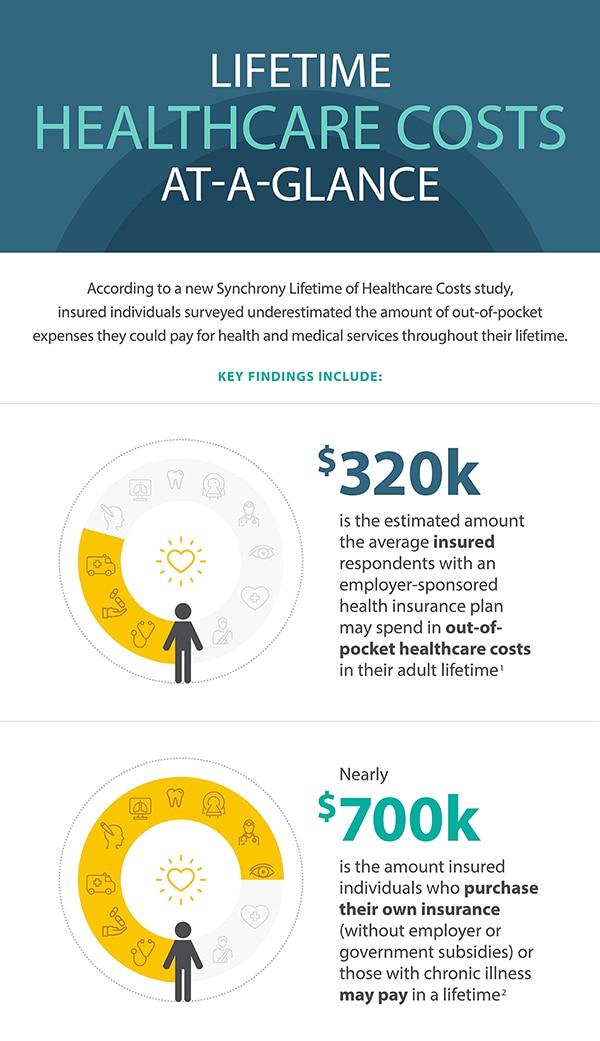

A Lifetime of Healthcare Could Cost Almost $320,000

According to Synchrony’s Lifetime of Healthcare Costs research, the average insured American with an employer sponsored health insurance plan could spend more than $320,000 in healthcare costs in their adult lifetime.1

This price tag doesn’t even account for a chronic illness, mental health services, or elective procedures. Too often, unexpected medical care can come with high co-pays, for things like:

- Scans

- Medical tests

- Specialists

- Lab work

- Accidents and medical emergencies

Check out this infographic highlighting some of the vital info included in the Lifetime of Healthcare Study (full study available for download here).

The CareCredit credit card can help fit care into your budget.*

See if you prequalify (no impact to your credit bureau score), and apply today

for the CareCredit health and wellness credit card.

Medical Expenses: Expectations vs. Reality

Even if individuals save for these costs, Synchrony’s study found that most respondents dramatically underestimate their out-of-pocket healthcare expenses.

While most guessed that they spent an average of $850 per year on healthcare costs (not including paid premiums), in reality, their actual expenses were closer to $2,100 annually – nearly 145% higher than respondents estimated.1

This discrepancy can lead many Americans to postpone getting medical care or seeing a specialist – especially younger generations.

The Human Price of Unexpected Healthcare Costs1

Synchrony’s study reveals that high costs of healthcare are causing people to consider delaying or forgoing recommended care and treatment and forcing them to choose between financial health and physical/mental wellbeing.

- 50% of Gen Z, Millennials, and Gen Xers, on average, said they would consider postponing non-urgent medical care if the cost is $500 - $999.

- 32% of Boomers said they would consider postponing non-urgent medical care if the cost is $500-$999.

- 25% of Gen Z, Millennials and Gen Xers, on average said they would consider delaying non-urgent medical care that costs less than $500.

- 65% of Millennials and 60% of Gen Xer’s said they were not financially prepared for their most costly out-of-pocket healthcare expense.

Healthcare Providers

Offering patients a variety of financing options helps give them peace of mind that they can complete treatment plans and pay with flexible financing with the CareCredit credit card.

How People are Paying for Healthcare

Health insurance can be a good first line of defense, but here are a number of ways to play for unexpected healthcare costs:

Health Savings Accounts (HSA): Available to those with a qualifying high-deductible health plan as a way to save pre-tax dollars specifically for health-related expenses.2

Flexible Spending Account (FSA): If you have health insurance through your work, an FSA, or Flexible Spending Account, is a pre-tax saving account that can be used for health-related expenses like copays, deductibles and prescriptions.3

Savings Account: Even a basic savings account through your bank can help you set aside money for unexpected medical costs not covered by your insurance.

CareCredit Credit Card: CareCredit is different from a general purpose credit card. More than 12 million people have CareCredit to help pay for out-of-pocket expenses not covered by medical insurance. Promotional financing options are available that you may not be able to get with other cards.* See if you pre-qualify today at www.carecredit.com/apply.

Download Synchrony’s Lifetime of Care Healthcare Costs Research

For more information about healthcare costs in the U.S., download the full study.