Americans May Forgo Dental Treatments Due to Cost, Risking Overall Health, New Synchrony Research Reveals

Dental Care Costs Can Range from $51,000 for Single Adult Coverage to $95,000 for Couple and Family Coverage During a Lifetime According to the Synchrony Dental “Lifetime of Care” Study

58% of Americans Say Dental Care is Not Affordable

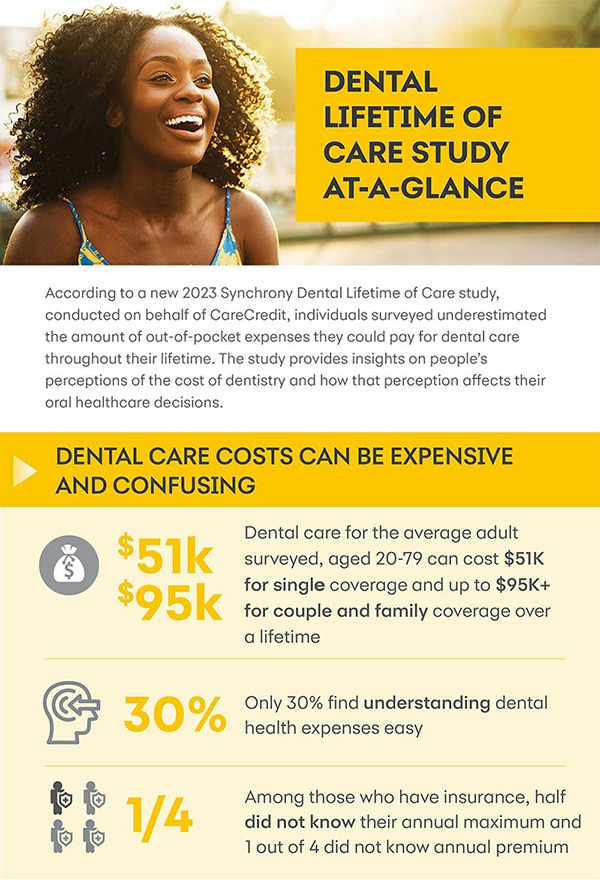

STAMFORD, Conn. – October 4, 2023 – Costs are a major factor impacting American’s dental care, according to new study results from Synchrony, a leading consumer financial services company, conducted on behalf of the company’s leading dental financial solution, CareCredit. Synchrony’s Dental "Lifetime of Care" study interviewed more than 1,000 insured and uninsured Americans between the ages of 20 and 79 about annual out-of-pocket dental costs and the financial, emotional, and psychological effects surrounding those costs.

“Dental health is essential to overall health, and rising out of pocket costs are preventing patients from accessing the care they want and need,” said Bete Johnson, Senior Vice President and General Manager, Dental, Synchrony. “We conducted this research to get a clear picture of what patients can expect in dental care costs during a lifetime – to help them plan ahead and connect them with the tools and resources to manage these costs.”

The report found that more than half (58%) of consumers expressed that dental care is not affordable, and for those living without dental insurance, that number rose to 75%. Results depicted that dental care for the average adult, aged 20-79 can cost $51,000 for single coverage and up to $95,000+ for couple and family coverage during a lifetime— and is only the tip of the iceberg. Additional care, like dental implants, orthodontia or more complex needs, could costs tens of thousands of dollars per procedure.

Cost as a Barrier to Dental Care

As a result of these costs, 9 out of 10 respondents (92%) said they would consider holding off on general dental care because of cost, with 4 out of 5 (83%) saying the same for emergency dental care. Fifty-four percent of the surveyed consumers cited costs as the primary reason they did not visit the dentist in the last year. Among consumers, people with dental insurance (78%) were more likely to visit the dentist than those without insurance (55%).

Data also showed the ability to afford dental care worsens as Americans age. When asked if dental care was affordable, 51% and 52% of Generation Z and Millennials said “no,” and that number increased for older generations— 61% of both Generation X and Baby Boomers as well as 67% of Silent Generation respondents reported dental care as not being affordable.

Are Consumers Prepared for Unexpected Dental Costs?

People are more likely to experience a dental emergency than they realize, with half of the survey respondents reporting at least one dental emergency in their lifetime and 13% reporting one in the last year. Despite this, just 26% of respondents said they actively save for dental expenses. Among those that do, on average, only $648 is saved—nearly two-thirds use a savings account and a quarter have a Health Savings Account (HSA) or FSA. More than half of all respondents (52%) said they would hold off general dental care if the out-of-pocket cost was up to $1,000.

The Impact of Delayed Dental Care

Nearly half of respondents who delayed care reported that delaying their recommended procedure caused additional dental issues. Poor dental health can lead to additional problems, as supported by a growing body of evidence that shows the connection between oral health and overall health.

“People should be able to access their routine dental care when they need and want it, just as they should with other aspects of their wellness,” added Johnson.

With patients shouldering more financial responsibility for their dental care because of higher out-of-pocket costs, rising costs can result in people choosing between their financial and their physical health.

“The research findings are important because the reality is that patients are far more likely to delay dental care because of the associated costs,” said Dr. Brian Harris, DDS. “I believe it’s important to have full transparency with patients about the cost of their care so they can know their options before they sit in my chair. I think the findings of this study highlight just how important that step is to ensuring people can plan, pay for and ultimately receive the care they need.”

The Importance of Financial Support

Increasingly, dentists are looking to external support to maintain financial operations while ensuring patients are getting the experience they want and financial support they need. Synchrony, a leader in consumer lending for more than 90 years, has also been a leading financial solutions provider in the dental space with its CareCredit credit card for more than 35 years.

CareCredit is accepted in 80% of dental practices across the country and is a convenient and reliable solution that offers financing options for qualified consumers. CareCredit is integrated in many of the top dental practice management software solutions available today, making it easy for dental teams to offer to patients and for patients to apply. It fulfills the evolving needs and expectations of patients, empowering people to pay for the health and wellness care they want or need in a way that fits within their budget.

Synchrony is providing the resources and tools to help educate patients on dental costs and the financial solutions they can use to plan and pay for care. To read the Synchrony Lifetime of Dental Care Costs research or to find content about solutions to pay for dental care with or without insurance, and opportunities to ask questions of care experts, please visit www.dentallifetimeofcare.com. To learn more about CareCredit, please visit: www.carecredit.com.

Methodology

The Synchrony Dental “Lifetime of Care” study was performed by ASQ360 Market Research and Stephens & Associates on behalf of Synchrony. Researchers surveyed 1,335 respondents in the U.S (aged 20-79+), including 93 members of Gen Z (born after 1996), 360 Millennials (born 1977 – 1996), 374 members of Gen X (born 1965 to 1976), 427 Boomers (born 1946 to 1964) and 81 members of the Silent Generation (born before 1946). Researchers also conducted 22 dentist/practice manager interviews. The survey and interviews were conducted in January 2023.

About Synchrony

Synchrony (NYSE: SYF) is a premier consumer financial services company delivering one of the industry’s most complete digitally enabled product suites. Our experience, expertise and scale encompass a broad spectrum of industries including digital, health and wellness, retail, telecommunications, home, auto, outdoor, pet and more. We have an established and diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers, which we refer to as our “partners.” We connect our partners and consumers through our dynamic financial ecosystem and provide them with a diverse set of financing solutions and innovative digital capabilities to address their specific needs and deliver seamless, omnichannel experiences. We offer the right financing products to customers in their channel of choice. For more information, visit www.synchrony.com and Twitter: @Synchrony.

626-250-1415

626-250-1415 Michelle.Romero@syf.com

Michelle.Romero@syf.com