You may be able to enhance the patient payments process: Strategies to consider

By focusing on strategies to improve the patient payments process, providers can help patients pay for the care they want and need while simultaneously recouping necessary revenue.

By Lisa Eramo

Posted Sep 13, 2024 - 7 min read

High-quality patient care: It’s what every health and wellness provider nationwide strives to offer. To make this goal a reality, health and wellness providers need incoming revenue. The challenge? Revenue doesn’t just come from payers anymore. It comes from patients, too. And patient payments is a sensitive topic. You need empathy, compassion, and a strategic focus on creating a stellar patient financial journey. This article makes the case for offering patient financing options and following other best practices for patient payments. The goal is to improve your patient payments process and help your patients manage the cost of the care they want or need.

Why Do Providers Need Effective Patient Payments Strategies?

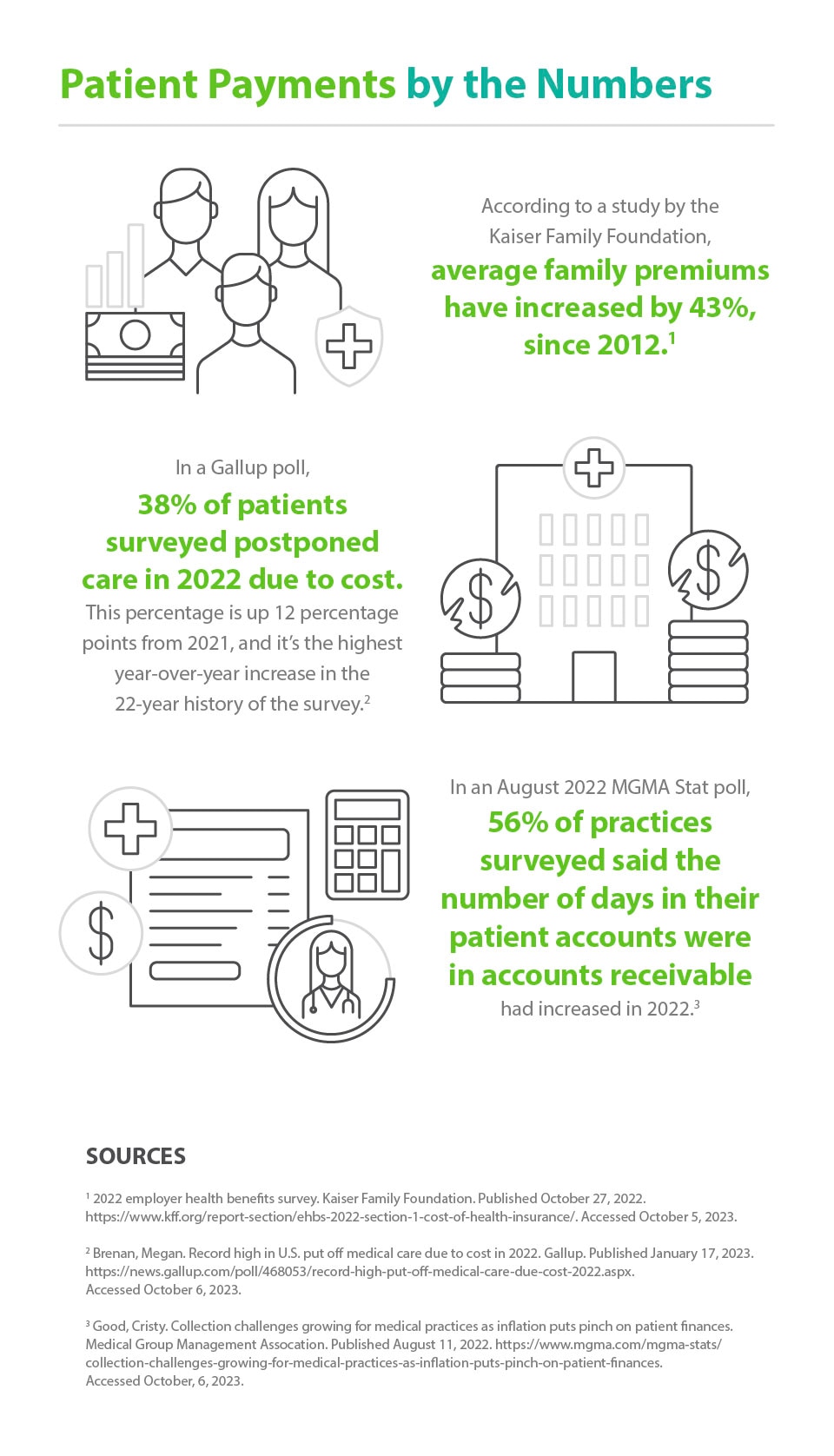

In an era of high deductible health plans (HDHP), patients are paying a larger percentage of medical costs. In fact, since 2012, average family premiums have increased 43%.

By focusing on strategies to improve patient payments, you can help patients pay for the care they need while simultaneously recouping necessary revenue. The financial wellness of health and wellness institutions can also be good for the health of communities because it ensures patients can access health and wellness care.

Why Do Some Providers Struggle to Explain the Cost of Care to Patients?

One of the biggest challenges for many providers is that they don’t have the right tools to financially empower their patients. More than half (51 percent) of doctors surveyed by the Physicians Advocacy Institute (PAI) say most of their patients ask about the cost of care (i.e., how much they’ll have to pay out of pocket). Moreover, 75 percent of physicians surveyed say they don’t have the information they need for these discussions, including details such as the health insurer deductible amount, the deductible balance due, the amount of adjusted bills, and the construction of the benefit design.

In addition, doctors may question the precision of cost estimates. More than half (54 percent) of doctors surveyed say real-time benefit checks of health insurance costs aren’t always accurate. These estimates may not consider recent visits with other providers. For example, a patient seeing a cardiologist may have already met their deductible at a recent appointment with a urologist that hasn’t been billed and processed. The patient may think they’ll owe the full cost of the visit, when in fact they may owe only a portion. Likewise, depending on the services the patient needs — which doctors can’t always determine in advance — providers may run the risk of underestimating costs. Inaccurate estimates can increase patient dissatisfaction and negatively affect patient retention.

Providers can enhance their patient payments process by providing accurate cost estimates with honest and transparent caveats. When patients have a good sense in advance of what they’ll owe — and the provider offers flexible patient financing options — they may be more willing to move forward with the treatment plan and get the care they need.

What is the Impact on Providers When They Don’t Effectively Address the Patient Responsibility?

When providers don’t effectively address patients’ financial responsibilities, their fiscal health may suffer. In addition, without an effective way to improve the patient payments process, health professionals may waste valuable time that they could spend on direct patient care. Effectively managing patient payments can help providers reduce accounts receivable, increase cash flow, reduce billing expenses, and more.

When you improve the patient payments process, you may also improve patient outcomes. Four out of five independent doctors in the United States surveyed say their patients refuse or delay care due to concerns about cost, and nearly just as many (79 percent) say high insurance deductibles are a leading cause of patient concerns about costs. By offering patient payment options and using flexible financing options, providers may empower patients to choose the best options for their wellbeing.

What Are Some Strategies to Enhance the Patient Payment Process?

Here are nine simple strategies health and wellness providers can use to help enhance the payment process and improve patient satisfaction.

- Focus on price transparency. When patients know in advance how much services will cost, they may be more willing to pay at the point of service or use a payment option with flexible financing options

- Prevent surprise health and wellness bills. An unexpected bill may not only go unpaid; it can also erode patient trust. To try to combat some of these surprises, identify whether your providers are out-of-network and provide a notice and consent for balance billing. This step is a requirement under the No Surprises Act that restricts surprise billing for patients in job-based and individual health plans who get emergency care and non-emergency care from out-of-network doctors at in-network facilities.

- Invest in price estimation. When it comes to interacting with your insured patients, your employees should have the tools to estimate patient responsibility and improve the point-of-service payment process. These tools should provide up-to-date information about patient balances and financial obligations.

- Create steps to verify billing information. Cost estimates are only as accurate as the insurance information on which they’re based. It’s a good idea to verify patient insurance information as an essential component of timely, accurate billing. An outdated insurance policy or incorrect insurance ID will yield inaccurate cost estimates.

- Strategically design patient statements. You may see better results if you use plain-language explanations and clearly spell out details such as the provider’s name, contact information, service rendered, date of service, amount the insurance paid, amount due from the patient, and payment options. It can also be helpful to use a variety of fonts, colors, and section headers to emphasize important information.

- Send patient statements as soon as you receive the explanation of benefits from the insurance company. The longer you wait, the more likely patients may be to forget the services they received.

- Give patients several ways to pay. Consider offering payment via an online portal, credit cards, checks, cash, and a patient financing option.

- Provide patients with support. Consider publicizing a toll-free number for patients to call to receive assistance in financial matters. Ideally, include after-hours support.

- Train your billing employees. Help your employees feel confident in their ability to help patients manage their balances. Consider providing training for anyone engaging in patient financial discussions, including registration employees, financial counselors, financial clearance representatives, and customer service employees. Training topics may include patient financial clearance best practices, financial assistance policies, and common coverage solutions for the uninsured and underinsured. It may also include standard language to guide employees on common types of patient financial discussions. More than anything else, it’s a good idea for employees to communicate with compassion and empathy.

Conclusion

As health and wellness providers continue to offer high-quality patient care, they can simultaneously address the patient responsibility and provide flexible patient financing options that promote patient payments best practices. Flexible financing can empower patients to pay their bills in a way that helps fit their monthly budgets. Providers can offer a third-party financing solution to help improve cash flow and reduce accounts receivable. Ultimately, flexible financing solutions help patients pay for the care they want or need over time, making it a win-win for everyone.

About the Author

Lisa A. Eramo

Lisa A. Eramo is a freelance healthcare writer with more than a decade of experience writing for healthcare executives, managers, physicians, and consumers. She contributes to various trade publications and also assists clients with healthcare content marketing efforts. Learn more at www.lisaeramo.com.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.