How to Help Your Patients Navigate the Annual Deductible Reset

Improve the patient-provider relationship by engaging in conversations about the annual deductible reset.

By Lisa Eramo

Digital Writer

Posted Feb 07, 2025 - 7 min read

Let’s face it: Your patients lead busy lives. Some may be trying to manage multiple chronic conditions. Others may be juggling work, family and the demands of everyday life. Considering all these stressors, their annual health insurance deductible reset may not be top of mind.

That’s why it’s important to remind them that the patient's responsibility could change at the beginning of each new year. The cost difference for care could be significant, especially for the growing number of people with high deductible health plans (HDHPs).

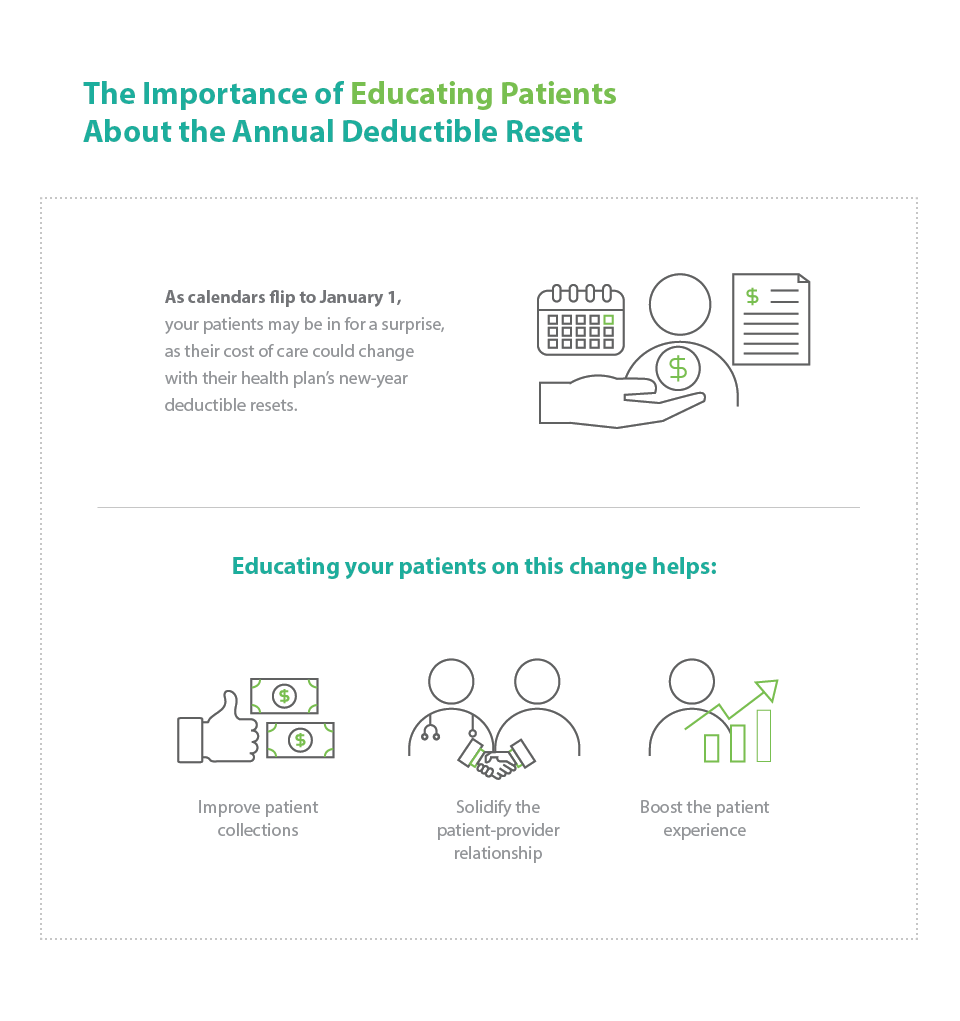

When you educate patients about their deductible reset, it can help improve healthcare billing, solidify the patient-provider relationship and boost the patient's financial experience. This article explains how you can communicate with patients about their insurance policy deductible reset and why it’s important to do so.

Learn More

Are you ready to offer patient financing solutions? Learn more about becoming a CareCredit provider: Get started

Communicating With Patients About the Annual Deductible Reset

Over time, many patients get used to paying a standard copayment amount for healthcare services and may plan ahead to manage their finances accordingly. Patients may appreciate a sense of predictability and stability.

Then January 1 — or the anniversary date of their health plan — rolls around. Patients come in for a procedure or other service, and those with an HDHP receive a much larger bill than they may have paid previously. They may not understand that the patient's responsibility may have changed when their deductible reset.

Insurance deductibles typically reset on January 1, though some plans’ deductibles may reset on a different date, such as when the patient signed up for their plan. In either case, the resulting confusion about the reset can negatively affect the patient-provider relationship and potentially erode patient trust. The good news is that proactive education about the patient deductible can help.

One of the biggest reasons to educate patients about the deductible reset is that it may have a profound effect on a large portion of your patient population. In 2022, 53.6% of the U.S. private-sector workforce was enrolled in an HDHP.1 (Note: In 2024, HDHPs have a deductible of at least $1,600 for an individual or $3,200 for a family.2)

When the deductible resets, patients are responsible for the entire health plan deductible amount before their insurance coverage kicks in. They may also need to pay monthly premiums, some of which have risen higher than wages and inflation.3 Helping patients understand their potential financial responsibility after a deductible reset can improve the overall patient financial experience while simultaneously improving patient satisfaction. When patients understand that their healthcare bill is accurate, they feel more comfortable paying it.

Financial Concerns Can Lead to a Delay in Care

Even if patients are aware of the annual patient deductible reset, some may feel uncomfortable bringing up financial concerns and choose to delay care instead. A 2024 West Health-Gallup survey found that an estimated 72.2 million American adults — about 1 in 3 — had not sought treatment for needed healthcare in the previous three months due to the cost. An estimated 38.7 million had skipped needed medicine their doctor prescribed because of the cost.4

And those delays in care can cause larger problems. When patients postpone necessary care, they may require higher hospitalizations over time.5 And CareCredit’s own 2022 study on healthcare costs found that 46% of the people who had delayed care because of cost said the delayed care caused further medical problems.6

It’s important to spark conversations about the deductible reset and any changes in patient responsibility. It’s also helpful to provide options for patients to pay over time, including flexible financing options that help patients manage the cost of care with convenient monthly payments.

Mitigating the Impact of High Deductibles on Providers

HDHPs don’t just affect patients; they impact healthcare providers, too. When patients don’t understand their financial position after a deductible reset — or they aren’t connected with the right financing options to make care more affordable — providers could end up eating those costs if patients are unable to pay their medical bills.

In fact, uncompensated care, where the health system or practice provides care but receives no payment, has been on the rise over the last decade. Between 2000 and 2020, hospitals provided more than $745 billion of uncompensated care, according to the American Hospital Association (AHA).7 Meanwhile, according to a 2023 CareCredit study, healthcare practices have 8% to 18% of accounts that are delinquent.8

The financial stress of uncompensated care could impact your ability to provide an optimal standard of patient care. As uncompensated care increases, you may have less financial flexibility for essentials like paying physicians and employees, obtaining essential supplies or providing other health and wellness initiatives. Educating patients about the annual deductible reset may enhance your ability to collect patient payments and reduce uncompensated care.

How to Start a Conversation With Patients About Their Deductible Reset

Consider these strategies to start discussions about the payment deductible.

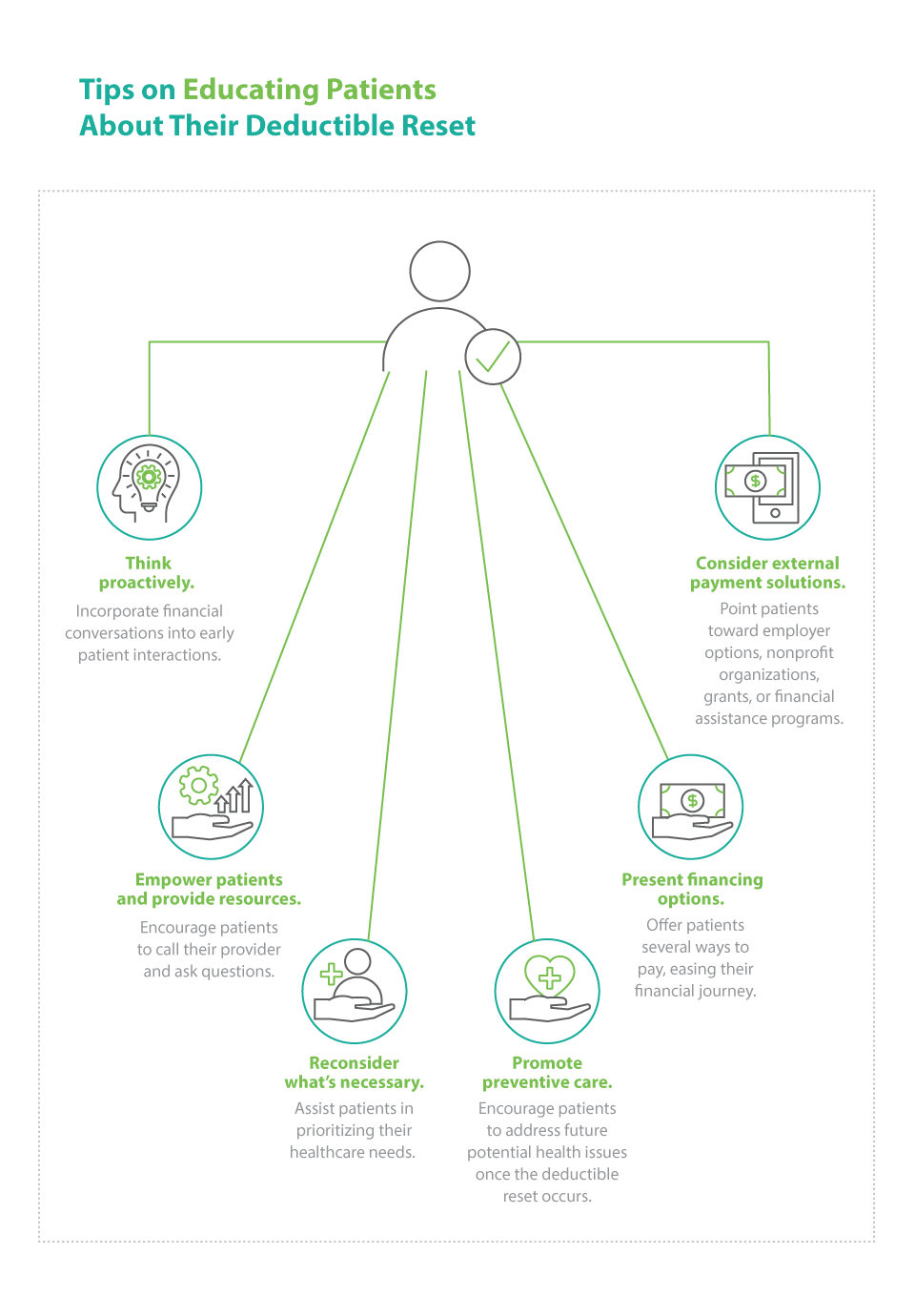

1. Think proactively. Routinely incorporate financial conversations into your patient’s first visit of the year. Consider reminding patients that their deductible may reset and helping them understand what the reset means in terms of patient responsibility. Also, you may want to educate patients on how to understand an Explanation of Benefits statement so they can track how close they are to meeting their deductible or reaching their out-of-pocket maximum as the plan year progresses.

You might also consider communicating with patients about payment options when they make their medical appointment, or even before. The 2023 CareCredit study found that 33% of patients preferred to have that information at the time of scheduling an appointment, and 55% preferred to have that information before scheduling.8

Likewise, when you discuss patients’ health-related goals and recommend treatment plans that may require multiple visits and procedures, you can ask about potential financial barriers and educate patients about payment options.

2. Empower patients; provide resources. Remind patients where they can find the customer service number for their health insurance plan and encourage them to call and ask these questions:

- What is my patient deductible?

- Is my deductible different for in-network vs. out-of-network providers?

- When does my patient deductible reset?

- Which types of appointments count toward my deductible, and which ones don’t?

- What are my out-of-pocket costs?

- What is the annual out-of-pocket maximum?

Keep in mind that your patients may not understand some basics of their health insurance, including basic health insurance terms.

A 2023 KFF Survey of Consumer Experiences With Health Insurance found that:9

- 51% of insured adults said they found at least one part of how their insurance works at least somewhat difficult to understand.

- More than one-third — 36% — said it is at least somewhat difficult for them to understand what their insurance will cover.

- 30% said it is difficult for them to understand what they will owe out of pocket for a healthcare service.

- One-quarter said they have difficulty understanding insurance terms like “deductible,” “coinsurance” or “prior authorization.”

Consider providing your patients with a glossary of terms so they feel more confident when calling their health insurance company. The glossary could include definitions for an HDHP, deductible, preferred provider organization, out-of-pocket maximum, in-network vs. out-of-network status and more.

Learn More

Patient financing options help cover cost of care. Learn more about becoming a CareCredit provider: Get started

3. Reconsider what’s necessary. If cost is a concern, physicians could assist patients in prioritizing their needs. In these cases, patients may be able to address certain health issues sooner and wait until they’ve met their deductible to pursue other procedures or services without compromising their healthcare journey.

4. Promote preventive care. Under the Affordable Care Act, most private insurance and group health plans must provide preventive care at no out-of-pocket cost to the patient. Consider encouraging your patients to take advantage of these services so they can identify and address future potential health issues once the deductible reset occurs.

5. Present financing options. With rising healthcare costs, it’s important to assist patients along their financial journey. You may want to offer patients several ways to make their care more affordable, including flexible financing to help them fit care into their monthly budget.

6. Consider external payment solutions. For example, patients may be able to access options through their employers, such as health savings accounts (HSAs), health reimbursement accounts, flexible spending accounts and medical savings accounts. Some nonprofit organizations connect patients with financial assistance programs. Breakthrough T1D, for instance, is a type 1 diabetes research and advocacy organization that offers patients guidance on paying for prescription costs.10 The Patient Advocate Foundation assists eligible patients to cover copays and other expenses. Patients may also be able to take advantage of grants to help pay for drug costs.11 Moreover, some pharmaceutical companies offer patient financial assistance programs.

You can foster trust by serving as a source of accurate and easy-to-understand financial information, including a resource on patient deductibles. For example, you may want to proactively educate patients about what happens after a deductible reset and how they can prepare for their financial journey. You can also answer questions and provide patients with resources that address the patient deductible and define key terms related to the patient payment process.

An annual deductible reset doesn’t need to be a time of confusion and anxiety for patients. It can become an opportunity to improve the patient-provider relationship as well as the patient's financial journey.

A Patient Financing Solution for Health and Wellness Providers

If you are looking for a way to connect your patients with flexible financing that empowers them to pay for the care they want and need, consider offering CareCredit as a financing solution. CareCredit allows cardholders to pay for out-of-pocket health and wellness expenses over time while helping enhance the payments process for your practice or business.

When you accept CareCredit, patients can see if they prequalify with no impact to their score, and those who apply, if approved, can take advantage of special financing on qualifying purchases.* Additionally, your practice or business will be paid directly within two business days.

Learn more about the CareCredit credit card as a patient financing solution or start the provider enrollment process by filling out this form.

Author Bio

Lisa A. Eramo is a freelance healthcare writer with more than a decade of experience writing for healthcare executives, managers, physicians and consumers. She contributes to various trade publications and also assists clients with healthcare content marketing efforts.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedReady to help more patients and clients get the care they want and need?

Get StartedReady to help more patients and clients get the care they want and need?

Get Started* Subject to credit approval.

The information, opinions and recommendations expressed in the article are for informational purposes only. Information has been obtained from sources generally believed to be reliable. However, because of the possibility of human or mechanical error by our sources, or any other, Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) does not provide any warranty as to the accuracy, adequacy, or completeness of any information for its intended purpose or any results obtained from the use of such information. The data presented in the article was current as of the time of writing. Please consult with your individual advisors with respect to any information presented.

© 2025 Synchrony Bank.

Sources:

1 "Exploring cost and coverage rates in employer-sponsored insurance (infographic)," State Health Access Data Assistance Center. September 5, 2023. Retrieved from: https://www.shadac.org/news/cost-cov-ESI-2022

2 "Publication 969 (2023), Health savings accounts and other tax-favored health plans," IRS. September 9, 2024. Retrieved from: https://www.irs.gov/publications/p969#en_US_2023_publink1000204030

3 "2023 Employer health benefits survey," KFF. October 18, 2023. Retrieved from: https://www.kff.org/report-section/ehbs-2023-section-1-cost-of-health-insurance/

4 "West Health-Gallup 2024 survey on aging in America," West Health and Gallup. June 2024. Retrieved from: https://westhealth.org/wp-content/uploads/2024/06/West-Health-Gallup-2024-Aging-in-America-Survey-Report-FINAL.pdf

5 "Reduce the proportion of people who can't get medical care when they need it — AHS-04," Office of Disease Prevention and Health Promotion. Accessed October 11, 2024. Retrieved from: https://health.gov/healthypeople/objectives-and-data/browse-objectives/health-care-access-and-quality/reduce-proportion-people-who-cant-get-medical-care-when-they-need-it-ahs-04#

6 "2022 Lifetime of Healthcare Costs," CareCredit. August 2022.

7 "Fact sheet: Uncompensated hospital care cost," American Hospital Association. February 2022. Retrieved from: https://www.aha.org/fact-sheets/2020-01-06-fact-sheet-uncompensated-hospital-care-cost

8 "How cost impacts the patient and provider journey: The importance of consistent and proactive financing discussions," CareCredit. Accessed December 23, 2024.

9 Pollitz, Karen et al. "KFF survey of consumer experiences with health insurance," KFF. June 15, 2023. Retrieved from: https://www.kff.org/private-insurance/poll-finding/kff-survey-of-consumer-experiences-with-health-insurance/

10 "Help with costs," Breakthrough T1D. Accessed October 11, 2024. Retrieved from: https://www.breakthrought1d.org/t1d-resources/insurance/help-with-prescription-costs/

11 "Copay relief," Patient Advocate Foundation. Accessed October 11, 2024. Retrieved from: https://copays.org/