Patient Responsibility: Overview and Guidance for Healthcare Providers

Learn how patient financial responsibility works within the health and wellness billing process and what you can do to help patients understand and pay for their out-of-pocket expenses.

By Pamela Cagle, R.N. and Todd Murphy

Posted Feb 14, 2025 - 7 min read

With rising healthcare costs and more people opting for high deductible health plans (HDHPs), patient responsibility balances are accruing at higher rates. We know that the cost of healthcare can increase stress for patients1 and may also impact the financial stability of providers.

Fortunately, with a bit of education on both sides of the billing agreement, you can help solve some of the most common issues. This guide will address the challenges of managing patient responsibility in healthcare billing and offer effective strategies to help improve your processes.

What Is Patient Responsibility in Healthcare Billing?

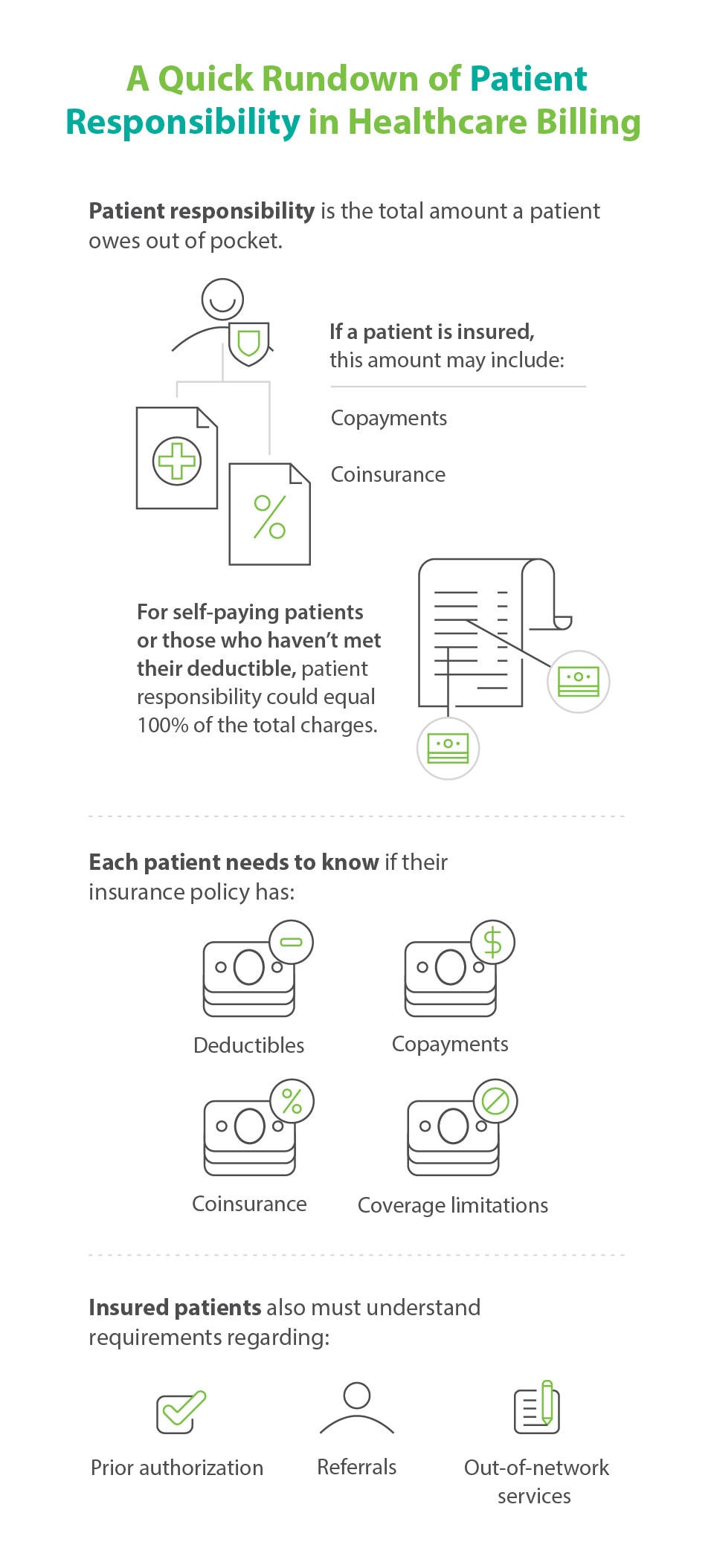

Patient responsibility in healthcare billing is the total amount a patient owes out of pocket. If the patient is insured, it may include copayments or coinsurance. For self-paying patients or those who haven’t met their deductible, patient responsibility for payment could equal 100% of total charges. A Medicare patient payment responsibility, once the deductible is met, is typically a coinsurance payment equal to 20% of the Medicare-approved amount.2

There are some additional patient responsibilities. It’s the patient’s responsibility to:

- Learn about the deductible, copayment, coinsurance, penalties and coverage limitations they're responsible for

- Provide the provider with the correct insurance information

- Understand the insurance company’s policies regarding prior authorization, referrals and out-of-network services

Why Are Patient Responsibility Balances Increasing?

Unexpected healthcare costs and high deductible health plans, along with increasing copayments and coinsurance, all contribute to higher out-of-pocket costs for patients. For example, according to data from KFF, the average single deductible in 2023 was $1,930, while the average family deductible was $3,733.3

Those numbers are much higher than in 2013, when the average single deductible was $1,273 and the average family deductible was $2,491.3 In 10 years, the average single deductible increased $657, or more than 50%, and the average family deductible increased $1,242, or almost 50%. Patients with high deductibles and high coinsurance amounts are responsible for a significant portion of provider reimbursement.

All of these financial challenges mean a significant portion of residents in the United States are delaying medical treatment because of costs. A U.S. Federal Reserve study found that 27% of U.S. adults decided to not get some medical care in 2023 because of cost.4

That means many of these patients eventually show up sicker and require more costly care. In fact, a 2022 study on healthcare costs conducted for CareCredit found that 46% of the people who had delayed care because of cost said the delayed care caused further medical problems.5

The Case for Transparent Pricing

The challenges of rising healthcare costs and out-of-pocket payments make the issue of transparent medical pricing more prevalent. The primary goal of new hospital and healthcare price transparency laws is to make sure both the cost and quality of healthcare are easily understandable.6 Transparent pricing helps patients make smarter financial decisions. But transparency in healthcare price and cost isn’t just about dollars. It’s also about helping patients understand the quality of patient care you provide.

Yet another benefit of transparency is that it enhances — and symbolizes — good communication between patients and providers. Effective communication helps providers and patients bond, improves patients’ adherence to a treatment plan and leads to better health outcomes for patients.7

How to Help Patients With Their Financial Responsibilities for Care

Helping patients understand their financial responsibility can help ensure better outcomes overall. Here are some ways you can assist.

Provide good information up front

A 2022 KFF survey of more than 2,300 adults — more than 1,200 with healthcare debt — found that 67% of respondents had not paid or only partially paid a bill because they didn’t have the money.8 But 44% said they didn’t pay because they weren’t sure the bill was accurate.8 A separate 2022 survey of more than 2,000 U.S. residents found that almost 40% were confused by their healthcare bills.9

Providers can help decrease this uncertainty and confusion. Providing information up front about patient responsibility for payment is one of the keys to receiving prompt payment and avoiding patient collections. Here are a few best practices to consider:

- Use pre-verification to help the patient and your office understand the patient’s insurance coverage, financial responsibility and reimbursement before you provide care. This should be a component of your pre-appointment planning as part of the health and wellness billing process.

- Streamline the research process by using a web-based patient responsibility tool.

- After you verify benefits, go over coverage, financial responsibility and exact payment expectations with the patient.

- Ensure the patient’s privacy before you discuss financial and protected health information.

- Avoid jargon when talking with patients. Your patient probably doesn’t speak “code” — at least not fluently.

- Use nonjudgmental and empathetic language to reduce feelings of embarrassment.

- Consider following a script in verbal communications with patients to help you stay on topic and ensure you hit all the important points.

- Provide the patient with a personalized estimation of benefits (EOB) statement that also includes your financial and payment policies.

- Keep communication open by encouraging patients to reach out with further questions.

Providing a high level of financial clarity allows you to connect with patients on a personal level while empowering patients in their healthcare decisions.

Focus on patient education

While not directly related to patient responsibility, researchers have linked patient education to better patient outcomes and lower healthcare costs.10 Another benefit of patient education is that it helps patients better understand the value of the care for which they are paying. The term “value-based care” isn’t just a Medicare buzzword. Just as Medicare rewards quality of care and outcomes, so do patients.

Help the uninsured understand patient responsibility

Patient financial responsibility and healthcare costs are barriers to care for most uninsured patients. When patients lose access to health insurance, they often miss out on preventive care and may be more likely to wait until they are sicker to seek care. Sicker patients who have delayed seeking care will often have higher healthcare costs.11

It’s easy to offer a price quote when there is no insurance to verify, but does this step alone serve your patient’s needs? Going the extra mile for a patient with no insurance may have more benefits than you realize. If nothing else, you could build trust and goodwill. Best case, you’ll end up with a highly engaged patient.

Here are three strategies to consider for helping uninsured patients and those with high deductible health plans meet their patient responsibility:

- Offer a cash discount. Determine what it’s worth to get payment in full versus potentially dealing with expensive and time-consuming administrative processes later.

- Search benefit discovery databases. The software may flag the patient as a potential candidate for Medicare, Medicaid or other low-cost commercially available insurance. Surprisingly, some patients have insurance policies they’ve forgotten about, and insurance discovery solutions may help you locate them.

- Refer to private charity networks. In the United States, more than 1,400 charity clinics serve low-income families, including uninsured families.12 Fees at a charity hospital are flexible based on the patient’s income.

Consider a patient portal

Patient portals with intuitive payment systems can help streamline the patient experience and lower administrative costs. A patient portal should allow patients to update insurance information and payment methods. Patients can begin the pre-verification process online when it is convenient, and then you can follow up with them during business hours. Plus, communicating through the portal may be more private and secure than other options.

A patient portal can also benefit your practice or health system and can be an important part of an effective healthcare revenue cycle management system.

Offer financing options for patient responsibility

Patients address barriers to care in different but predictable ways. According to a Healthcare.com survey, over 60% of respondents said they had received care they couldn’t afford, knowing it would add to the healthcare costs they already owed.13

Patients are looking for ways to manage the cost of care, and offering financing is a great option. Offering financing for costs that are the patient's responsibility may help them move forward with care recommendations.

You might also consider communicating with patients about their payment options when they make their medical appointment, or even before. A 2023 CareCredit study found that 33% of patients preferred to have that payment option information at the time of scheduling an appointment, and 55% preferred to have that information before scheduling.14

But in-house financing can be tricky, as it carries risk for the provider. Without a financing partner, you could run afoul of state and local lending regulations or end up paying a medical collection agency to recover pennies on the dollar.

Healthcare financing can may offer a way for patients to pay their bills over time. Patients approved for financing may make an immediate payment toward the costs that are their responsibility. Short- and long-term financing options can help patients finance the health services they want and need and move forward with care recommendations. Patients might also benefit from other options, like the CareCredit credit card.

Final Thoughts: Addressing Patient Responsibility

Healthcare costs that outweigh a patient’s budget and the increased use of HDHPs are just two reasons more patients carry balances. The good news is that, by implementing some of the strategies in this article, you may have a better shot at helping your patients manage their out-of-pocket costs.

It may not be comfortable to talk about money with patients, but it doesn’t have to be difficult. Following a script in verbal communications with patients can help you better communicate financial responsibility. And you may be able to improve patient satisfaction by offering on-the-spot solutions such as patient financing.

A Patient Financing Solution for Health and Wellness Providers

If you are looking for a way to connect your patients with flexible financing that empowers them to pay for the care they want and need, consider offering CareCredit as a financing solution. CareCredit allows cardholders to pay for out-of-pocket health and wellness expenses over time while helping enhance the payments process for your practice or business.

When you accept CareCredit, patients can see if they prequalify with no impact to their score, and those who apply, if approved, can take advantage of special financing on qualifying purchases.* Additionally, your practice or business will be paid directly within two business days.

Learn more about the CareCredit credit card as a patient financing solution or start the provider enrollment process by filling out this form.

Author Bios

Pamela Cagle is a freelance writer based in Birmingham, Alabama. She leverages her background in healthcare and patient education to create helpful content that is informative, meaningful and easy to understand.

Todd Murphy is a professional writer and editor with more than 30 years of experience, including two decades as a newspaper and magazine journalist. He has worked with hospitals, academic health centers, universities and other institutions to create content for various audiences, with a focus on providers, patients, prospective patients and the general public.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get Started* Subject to credit approval.

The information, opinions and recommendations expressed in the article are for informational purposes only. Information has been obtained from sources generally believed to be reliable. However, because of the possibility of human or mechanical error by our sources, or any other, Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) does not provide any warranty as to the accuracy, adequacy, or completeness of any information for its intended purpose or any results obtained from the use of such information. The data presented in the article was current as of the time of writing. Please consult with your individual advisors with respect to any information presented.

© 2025 Synchrony Bank.

Sources:

1 “Medical debt burden in the United States,” Consumer Financial Protection Bureau. February 2022. Retrieved from: https://files.consumerfinance.gov/f/documents/cfpb_medical-debt-burden-in-the-united-states_report_2022-03.pdf

2 “Costs,” Medicare.gov. Accessed January 22, 2025. Retrieved from: https://www.medicare.gov/basics/costs/medicare-costs

3 “Average annual deductible per enrolled employee in employer-based health insurance for single and family coverage,” KFF. Accessed January 22, 2025. Retrieved from: https://www.kff.org/other/state-indicator/average-annual-deductible-per-enrolled-employee-in-employer-based-health-insurance-for-single-and-family-coverage/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

4 "Economic well-being of U.S. households in 2023,” U.S. Federal Reserve. May 2024. Retrieved from: https://www.federalreserve.gov/publications/files/2023-report-economic-well-being-us-households-202405.pdf

5 “Lifetime of healthcare costs research,” ASQ360° Market Research on behalf of CareCredit. August 2022. (CareCredit is a Synchrony solution.)

6 “Hospital price transparency,” Centers for Medicare & Medicaid Services. September 10, 2024. Retrieved from: https://www.cms.gov/priorities/key-initiatives/hospital-price-transparency

7 Sharkiya, Samer H. “Quality communication can improve patient-centered health outcomes among older patients: A rapid review,” BMC Health Services Research. August 22, 2023. Retrieved from: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10464255/

8 Lopes, Lunna et al. “Health care debt in the U.S.: The broad consequences of medical and dental bills,” KFF. June 16, 2022. Retrieved from: https://www.kff.org/report-section/kff-health-care-debt-survey-main-findings/

9 “Nearly 40% of Americans confused by medical bills.” AKASA. December 16, 2022. Retrieved from: https://akasa.com/press/nearly-40-of-americans-confused-by-medical-bills/

10 Chase, Deborah. “Patients gain information and skills to improve self-management through innovative tools,” The Commonwealth Fund. Accessed January 22, 2025. Retrieved from: https://www.commonwealthfund.org/publications/newsletter-article/patients-gain-information-and-skills-improve-self-management

11 Jain, Sanjula. “Delayed care leads to increased costs for patients and payers alike,” The Compass. July 31, 2022. Retrieved from: https://www.trillianthealth.com/market-research/studies/delayed-care-leads-to-increased-costs-for-patients-and-payers-alike

12 “By the numbers,” The National Association of Free and Charitable Clinics. Accessed January 22, 2025. Retrieved from https://nafcclinics.org/

13 Grunebaum, Dan. “Americans knowingly going into medical debt: Survey,” Healthcare.com. March 15, 2022. Retrieved from: https://www.healthcare.com/americans-knowingly-going-into-medical-debt-survey-481593#survey

14 Healthcare Journey Research Consumers and Providers study, Synchrony, 2023. (CareCredit is a Synchrony solution.)