Imagine you're at the dentist for a routine cleaning, and they find a hidden cavity that needs immediate attention. The filling may be covered by dental insurance, but the cosmetic procedure they recommend to restore your smile's charm is not. The unexpected cost could be a strain on your budget or cause you to delay other health and wellness treatments.

A credit card with promotional financing might be the answer. Deferred interest promotional financing can allow you to pay for big-ticket and other items and make monthly payments for a certain period of time, with interest assessed only if the promotional balance is not paid off within the promotional period.

What Is Promotional Financing?

Promotional financing, which may be available with a credit card, is a way to pay for certain purchases over a period of time. Depending on the type of promotional financing you have, if you do not pay off the entire balance within the promotional period, you could have to pay interest. Or, the remaining balance may start to accrue interest. Or, you may have to pay interest but at a reduced rate.

Three Types of Promotional Financing

You can find promotional financing on many types of credit cards. Many promotional financing offers fall into one of three categories:

1. Deferred interest. Deferred-interest financing means you won't pay any interest if you pay your promotional balance in full by the end of the agreed-to promotional period. Interest still accrues from the date of purchase, though, so if you don't pay off the balance in full by the end of the promotional period, that accrued interest will be added to your balance. Depending on your purchase cost, that could mean shelling out an additional significant cost. Deferred-interest financing may be advertised as "no interest if paid within X months."

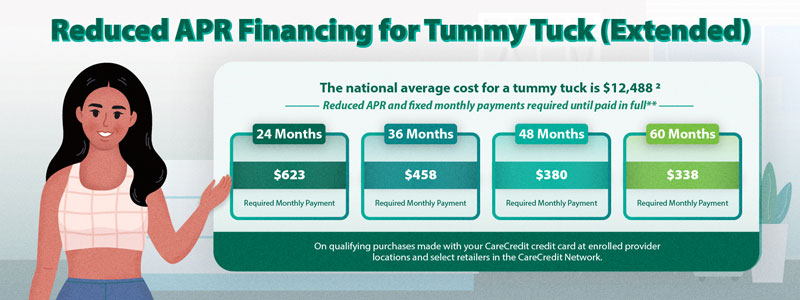

2. Reduced APR with fixed monthly payments. With this type of promotional financing, you pay for your qualifying purchase over a specified amount of time with a reduced APR. For example, “17.90% APR with 24 monthly payments." APR stands for annual percentage rate, and your card's APR determines how much interest can accrue on your balance. Monthly payments are based on the initial purchase amount, a promotional period and an interest rate.

3. No interest. A no-interest offer will give you a 0% APR that may expire at the end of the promotional period or it may require equal monthly payments that allows you to pay the entire balance by the end of the promotional period so you won't pay interest. As with any credit card, if you're carrying a balance, you need to make at least the required minimum monthly payments even if you're not charged interest.

How Promotional Financing Works With the CareCredit Credit Card

CareCredit's promotional financing options can help you pay for out-of-pocket health costs (including for your pets!), that cosmetic procedure you've always wanted or other health and wellness expenses that aren't covered by insurance. CareCredit offers two types of promotional financing options:

- Deferred interest financing. No interest if paid in full within six, 12, 18 or 24 months on qualifying purchases of $200 or more made with your CareCredit credit card account at enrolled provider locations and select retailers in the CareCredit network. Interest will be charged to your account from the purchase date if the promotional balance is not paid in full within the promotional period. Minimum monthly payments required.*

- Reduced APR financing. Reduced APR with fixed monthly payments required until paid in full on qualifying purchases made with your CareCredit credit card at enrolled provider locations and select retailers in the CareCredit network.** Purchases of $1,000 or more are eligible for a 24-month offer with a 17.90% APR, 36-month offer with an 18.90% APR, 48-month offer with a 19.90% APR. Purchases of $2,500 or more are eligible for a 60-month offer with a 20.90% APR.**

These promotional financing options can help make it easy to meet your health wants and needs and manage your finances. Additionally, CareCredit's online tools and mobile app, including an Acceptance Locator, help you make decisions, manage your budget and even pay a provider directly.

Additional Tips About Promotional Financing

Promotional financing with credit cards might make sense when you want to pay over time. As long as you keep on top of your payments and watch the calendar, these offers can be helpful for any budget.

Use these tips to make the most of your promotional financing offer:

Understand when the promotional period ends

Try to pay off your balance prior to that date. Check to see if making only the required minimum monthly payment is adequate to pay off the balance in time. If not, you may want to pay a little more (or be ready to make a larger final payment at the end of the promotional period).

Make on-time payments

This should be consistent throughout the promotional period. It's important not only for meeting the terms of your promotional financing but also for protecting your credit score and steering clear of late fees.

Keep track of your promotional purchases

If you have other purchases on the same card during the promotional period, make sure you understand how any excess payments above the minimum payment will be allocated.

If excess payments are allocated to non-promotional balances, it could cause you to fall short of your final payoff goal by the end of the promo period. Contact your credit card issuer if you have questions or would like to ask about allocating payments differently as you may have some discretion.

Managing Health and Wellness Costs With the CareCredit Credit Card

If you are looking for an option to help manage your health and wellness costs, consider financing with the CareCredit credit card. Get the care you want or need with easy, flexible financing options that allow you to pay for out-of-pocket expenses over time.*** Use our Acceptance Locator to find a provider near you that accepts CareCredit. Continue your wellness journey by downloading the CareCredit Mobile App to manage your account, find a provider on the go and easily access the Well U blog for more great articles, podcasts and videos.

Your CareCredit credit card can be used in so many ways within the CareCredit network including for vision, dentistry, cosmetic, pet care, hearing, health systems, dermatology, pharmacy purchases and spa treatments. How will you invest in your health and wellness next?

Author Bio

Louis DeNicola is a freelance writer who specializes in consumer credit, finances and fraud. He has several credit-related certifications and works with many lenders, publishers, credit bureaus, Fortune 500s and fintech startups.